Breaking

- MENU

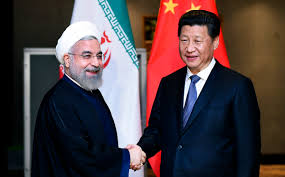

Conventional wisdom has it that China stands to benefit from the US withdrawal from the 2015 international nuclear agreement with Iran, particularly if major European companies feel that the risk of running afoul of US secondary sanctions is too high.

In doing so, China would draw on lessons learnt from its approach to the sanctions regime against Iran prior to the nuclear deal. China supported the sanctions while proving itself adept at circumventing the restrictions. However, this time round, as China joins Russia and Europe in trying to salvage the deal, things could prove to be different in ways that may give China second thoughts.

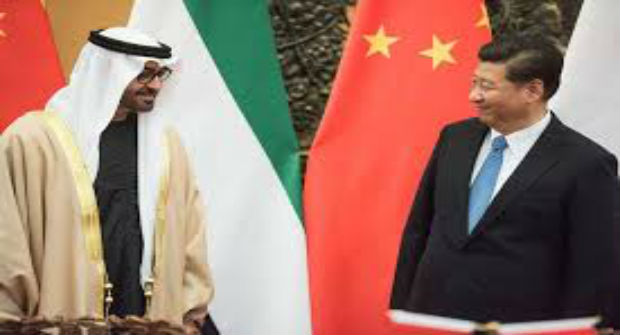

The differences run the gamut from an America that has Donald Trump as its president to a Middle East that is much more combative and assertive and sees its multiple struggles as existential, at least in terms of regime survival. Fault lines in the Middle East have hardened because of Israel, Saudi and United Arab Emirates assertiveness, emboldened by both a US administration that is more partisan in its Middle East policy, yet at the same time less predictable and less reliable.

Add to this Trump’s narrow and transactional focus that targets containing Iran, if not toppling its regime; countering militancy, and enhancing business opportunities for American companies and the contours of a potentially perfect storm come into view.

That is even truer if one looks beyond the Gulf and the Levant towards the greater Middle East that stretches across Pakistan into Central Asia as well as China’s overall foreign trade. China’s trade with the United States stood last year at $636 billion, trade with Iran was in that same period at $37.8 billion or less than five per cent of the US volume.

The recent case of ZTE, one of China’s largest IT companies, tells part of the story. Accused of having violated sanctions, the US Department of Commerce banned American firms from selling parts to ZTE, bringing the company to near bankruptcy. Trump appears to be willing to help salvage ZTE, but the incident significantly raises the stakes, particularly as China and the United States try to avoid a trade war. That is but one consideration in China’s calculations. Potentially, other major bumps in saving the nuclear agreement lurk around the corner and could prove to be equally, if not more challenging.

Tensions in the Middle East are mounting. The fallout of Trump’s recognition of Jerusalem as the capital of Israel and seemingly unqualified backing of Israel in its almost certainly stillborn plan for peace with the Palestinian is reverberating. Discontent across the region simmers just below the surface, magnified by youth and next generations in countries like Syria and Yemen who have little to look forward to.

The bumps fall into three categories: the degree to which China feels that it can continue to rely on the US defence umbrella in the Gulf; pressure on China by Middle Eastern states to shoulder the responsibility that comes with being a great power, if not take sides; and change in a region that is in a process of transition that is volatile, violent and could take decades to play out.

Yet, as China takes stock of the Middle East’s volatility and China’s strategic stake in regional stability, it appears ill-equipped to deal with an environment in which its traditional policy tools either fall short or no longer are applicable. Increasingly, China will have to become a geopolitical rather than a primarily economic player in competitive cooperation with the United States, the dominant external actor in the region for the foreseeable future.

China has signalled its gradual recognition of these new realities with the publication in January 2016 of an Arab Policy Paper, the country’s first articulation of a policy towards the Middle East and North Africa. But, rather than spelling out specific policies, the paper reiterated the generalities of China’s core focus in its relations with the Arab world: economics, energy, counter-terrorism, security, technical cooperation and its Belt and Road initiative.

Ultimately however, China will have to develop a strategic vision that outlines foreign and defence policies it needs to put in place to protect its expanding interests; its role and place in the region as a rising superpower, and its relationship and cooperation with the United States in managing, if not resolving conflict.

To be sure, China is taking baby steps in that direction with its greater alignment with international moves to combat Islamic militancy even if its campaign in north-western China risks straining relations with the Islamic world, the creation of a military facility in Djibouti, work on a naval base in Pakistan’s Jiwari peninsula, and cross-border operations in Afghanistan and Tajikistan.

Those may be the easier steps. Dealing with partners like Saudi Arabia and the United Arab Emirates that seek to establish regional hegemony by imposing their will on others at whatever cost may be more difficult. So far, Saudi Arabia and the UAE have not pressured China to choose in their rivalry with Iran.

But it can only be a matter of time before they do, particularly if Chinese investment in Iran and trade were able to offset the impact of US sanctions to the degree that the Islamic republic is not forced to compromise. To evade that situation, China has offered to mediate between Saudi Arabia and Iran, an offer the kingdom was unwilling to take up.

China is not immune to Saudi pressure. To protect their Saudi and UAE interests, Chinese alongside Hong Kong and Japanese banks refused earlier this year to participate in a one-year extension of a $575 million syndicated loan to Doha Bank, Qatar’s fifth-biggest lender.

Similarly, Saudi Arabia in April forced major multi-national financial institutions to choose sides in the Gulf spat with Qatar. In response to Saudi pressure, JP Morgan and HSBC walked away from participating in a $12 billion Qatari bond sale opting for a simultaneous Saudi offering instead.

The stakes for Saudi Arabia in Iran are far greater than those in Qatar. Iran poses an existential threat to the House of Saud for reasons far more intrinsic than the accusations Riyadh lobs at Tehran. The more Iran is able to defeat US sanctions, the more Saudi Arabia is likely to push China and to reduce their support of the nuclear agreement. That pressure can take multiple forms. With US-backed efforts at regime change in Tehran potentially on the horizon, Saudi Arabia has put building blocks in place over the last two years.

Large sums originating in the kingdom have found their way to militant, virulently anti-Shiite, ultra-conservative Sunni Muslim madrassas or religious seminaries in the Pakistani province of Baluchistan that borders on the Iranian province of Sistan and Baluchistan.

A Saudi think tank allegedly backed by Crown Prince Mohammed bin Salman, has developed plans to stir unrest among the Baluch minority in Iran, partly in a bid to complicate operations at the Indian-backed port of Chabahar, a mere 75 kilometres up the coast from Gwadar, a crown jewel of the China Pakistan Economic Corridor, China’s $50 billion plus Belt and Road stake in Pakistan.

China, moreover, has so far relied on its economic clout as well as Saudi Arabia to remain silent about a crackdown in Xinjiang that targets Islam, putting the kingdom as custodian of Islam’s two most holy cities in an awkward position.

The long and short of all of this is that, in an environment in which the Middle East views conflicts as zero-sum games, China is likely to find it increasingly difficult to remain aloof and straddle both sides of the fence. Salvaging the Iranian nuclear deal could come at a cost China may not want to pay.

Note: This article was originally published in the blog, The Turbulent World of Middle East Soccer and has been reproduced under arrangement. Web link:

_____________________________________________________________

As part of its editorial policy, the MEI@ND standardizes spelling and date formats to make the text uniformly accessible and stylistically consistent. The views expressed here are those of the author and do not necessarily reflect the views/positions of the MEI@ND. Editor, MEI@ND: P R Kumaraswamy

James M. Dorsey is a Senior Fellow at the S. Rajaratnam School of International Studies as Nanyang Technological University in Singapore, co-director of the Institute of Fan Culture of the University of Würzburg, and the author of the blog, The Turbulent World of Middle East Soccer. Email: jmdorsey@questfze.com

The final run-up to the 2022 World Cup and the tournament's management is make-it-or-break-it ti.....

Former Qatari emir Hamad bin Khalifa Al Thani, the father of the Gulf state's current ruler, Tam.....

The Biden administration is mulling whether to grant Saudi Crown Prince Mohammed bin Salman sovereig.....

Qatar's 2022 World Cup promises to benefit not only itself but also to provide an unintended eco.....

A potential revival of the Iran nuclear accord is likely to test the sustainability of Middle Easter.....

With the fate hanging in the balance of the 2015 international agreement that curbed Iran’s nu.....

At first glance, there is little that Turkish President Recep Tayyip Erdogan, an Islamist and nation.....

Europe is likely to shoulder the brunt of the fallout of a rapidly escalating crisis over Ukraine. M.....

An Israeli NGO gives the United Arab Emirates high marks for mandating schoolbooks that teach tolera.....

How sustainable is Middle Eastern détente? That is the $64,000 question. The answer is probab.....

Qatar has begun to cleanse its schoolbooks of supremacist, racist or derogatory references as well a.....

Long banned, Christmas has finally, at least tacitly, arrived in Saudi Arabia; just don’t use .....

Increasingly, compliance with US sanctions against Iran could emerge as a litmus test of the United .....

Footballers with diametrically opposed views on homosexuality and alcohol consumption have sparked h.....

Saudi Islamic affairs minister Abdullatif bin Abdulaziz al-Sheikh has ordered imams in the kingdom t.....

The United States has signalled in advance of next week’s Summit for Democracy that it is unli.....

A cursory look at Saudi Arabia and Iran suggests that emphasizing human rights in US foreign policy .....

When seven-time Formula One world champion Lewis Hamilton wore a helmet this weekend featuring the c.....

It has been a good week for United Arab Emirates Crown Prince Mohammed bin Zayed. Headline-grabbing,.....

Just in case there were any doubts, Turkish Foreign Minister Mevlut Cavusoglu demonstrated with his .....

Sudan is the exception to the rule in the United Arab Emirates’ counterrevolutionary playbook......

Former Saudi intelligence chief Prince Turki AlFaisal Al Saud must have gotten his tenses mixed up w.....

An Indonesian promise to work with the United Arab Emirates to promote ‘moderate’ Islam .....

As Middle Eastern states attempt to manage their political and security differences, Muslim-majority.....

The future of US engagement in the Middle East hangs in the balance. Two decades of forever war in A.....

It may not have been planned or coordinated but efforts by Middle Eastern states to dial down tensio.....

Gulf States are in a pickle. They fear that the emerging parameters of a reconfigured US commitment .....

Two separate developments involving improved relations between Sunni and Shiite Muslims and women&rs.....

On their way from Tel Aviv airport to Jerusalem in 1977 then Israeli Deputy Prime Minister Yigael Ya.....

Saudi and Emirati efforts to define ‘moderate’ Islam as socially more liberal while bein.....

Turkish state-run television appears to have not gotten the message: Turkey and the United Arab Emir.....

The Taliban takeover of Afghanistan perpetuates a paradigm of failed governance in the Muslim world .....

Israel’s first post-Netanyahu government is seeking to rebuild fractured relations with the Je.....

Taliban advances in Afghanistan shift the Central Asian playing field on which China, India and the .....

Boasting an almost 1,000-kilometre border with Iran and a history of troubled relations between the .....

This month’s indictment of a billionaire, one-time advisor and close associate of former US Pr.....

A recent analysis of Middle Eastern states’ interventionist policies suggests that misguided b.....

The United States and Iran seem to be hardening their positions in advance of a resumption of negoti.....

A recent unprecedented alliance between Muslims and Evangelicals takes on added significance in a wo.....

China may have no short-term interest in contributing to guaranteeing security in parts of a swath o.....

The rise of hard-line President-elect Ebrahim Raisi has prompted some analysts to counterintuitively.....

US President Joe Biden may have little appetite for Israeli-Palestinian peace making but seems deter.....

Recent announcements by Crown Prince Mohammed bin Salman of plans to turn the kingdom into a transpo.....

Saudi Arabia has stepped up efforts to outflank the United Arab Emirates and Qatar as the Gulf&rsquo.....

Eager to enhance its negotiating leverage with the United States and Europe, Iran is projecting immi.....

Former Crown Prince Hamzah bin Hussein has papered over a rare public dispute in the ruling Jordania.....

Former Crown Prince Hamzah bin Hussein has papered over a rare public dispute in the ruling Jordania.....

In a sign of the times, Turkish schoolbooks have replaced Saudi texts as the bull’s eye of cri.....

Saudi Sheikh Salman al-Awdah, a popular but controversial religious scholar who has been mostly in s.....

Recent clashes in the Iranian province of Sistan and Balochistan highlight Iran’s vulnerabilit.....

Two decades of snail pace revisions of Saudi schoolbooks aimed at removing supremacist references to.....

A little acknowledged provision of the 2015 international agreement that curbed Iran’s nuclear.....

Religion scholar Esra Ozyurek has a knack for identifying trends that ring warning bells about where.....

A projected sharp reduction in trade between the United States and China in the next two years coupl.....

Public debates about China’s Middle East policy are as much internal Chinese discussions as th.....

Saudi Arabia has taken multiple steps to polish its tarnished image in advance of this weekend&rsquo.....

An Emirati offer to invest in Israel’s most controversial soccer club could serve as a figurat.....

A close read of the agreement between the United Arab Emirates and Israel suggests that the Jewish s.....

A rift between Pakistan and Saudi Arabia throws into sharp relief deepening fissures in the Muslim w.....

Rare polling of public opinion in Saudi Arabia suggests that Crown Prince Mohammed bin Salman may be.....

China is contemplating greater political engagement in the Middle East in what would constitute a br.....

Europe is progressively being sucked into the Middle East and North Africa’s myriad conflicts......

China looms large as a potentially key player alongside Russia and Iran in President Bashas al-Assad.....

Civilizationalist leaders, who seek religious legitimacy, cater to a religious support base or initi.....

A decision by the Organization of Petroleum Exporting Countries (OPEC) and non-OPEC producers like R.....

The Coronavirus pandemic points a finger not only at the colossal global collapse of responsible pub.....

Syria’s announcement of its first COVID-19 case highlights the public health threat posed by w.....

The fight in this week’s Democratic primaries may have been about who confronts Donald J. Trum.....

A podcast version of this story is available on Sound cloud, ITunes, Spotify, Stitcher, Tune In, Spe.....

Saudi Arabia may have been getting more than it bargained for when authorities in Khujand, Tajikista.....

At the core of US president Donald J. Trump’s maximum pressure campaign against Iran lies the .....

The Iranian port city of Bandar-e-Mahshahr has emerged as the scene of some of the worst violence in.....

Saudi efforts to negotiate an end to the Yemen war in a bid to open a dialogue with Iran could call .....

China is manoeuvring to avoid being sucked into the Middle East’s numerous disputes amid mount.....

Fears of a potential military conflict with Iran may have opened the door to a Saudi-Iranian dialogu.....

By the law of unintended consequences, US President Donald J. Trump’s mix of uncritical and cy.....

Little suggests that fabulously wealthy Gulf States and their Middle Eastern and North African benef.....

A controversial former security official and Abu Dhabi-based political operator, Mohammed Dahlan, ha.....

Russia, backed by China, hoping to exploit mounting doubts in the Gulf about the reliability of the .....

China and Russia are as much allies as they are rivals. A joint Tajik-Chinese military exercise in a.....

Thought that sectarianism was a pillar of the Saud Iranian rivalry? Think again, think Kashmir where.....

These are tough times for Saudi Arabia. The drama enveloping the killing of journalist Jamal Khas.....

Saudi plans to become a major gas exporter within a decade raise questions about what the .....

A Turkish-Chinese spat as a result of Turkish criticism of China’s crackdown on Turkic Mu.....

This week’s suicide attack on Revolutionary Guards in Iran’s south-eastern province of S.....

Saudi Crown Prince Mohammed bin Salman’s three-nation tour of Asia is as much about demonstrat.....

It may be reading tea leaves but analysis of the walk-up to Saudi crown prince Mohammed bin Salman&r.....

Alarm bells went off last September in Washington's corridors of power when John Bolton&rsq.....

US President Donald J. Trump’s threat to devastate Turkey’s economy if Turkish troo.....

Pakistan is traversing minefields as it concludes agreements on investment, balance of payments supp.....

A heavy soup made of pulled noodles, meat, and vegetables symbolizes Central Asia’s close cult.....

As far as Gulf leaders are concerned, President Donald J. Trump demonstrated with his announced.....

When President Recep Tayyip Erdogan recently declared that Turkey was “the only country that c.....

A draft US Senate resolution describing Saudi policy in the Middle East as a "wrecking ball&quo.....

As Saudi crown prince Mohammed bin Salman tours friendly Arab nations in advance of the Group of 20 .....

When Saudi General Khalid bin Sultan bin Abdul Aziz went shopping in the late 1980s for Chinese medi.....

Pakistani Prime Minister Imran Khan lands in Beijing on November 3, the latest head of government to.....

Saudi Arabia and Turkey, despite being on opposite sides of Middle Eastern divides, are cooperating .....

It’s easy to dismiss Iranian denunciations of the United States and its Middle Eastern allies .....

An attack on a military parade in the southern Iranian city of Ahwaz is likely to prompt Iranian ret.....

A Financial Action Task Force (FATF) report criticizing Saudi Arabia’s anti-money laundering a.....

Desperate for funding to fend off a financial crisis fuelled in part by mounting debt to China, Paki.....

Iran has raised the spectre of a US-Saudi effort to destabilize the country by exploiting .....

A possible ceasefire between Israel and Hamas, the Islamist group that controls the Gaza S.....

With multiple Middle Eastern disputes threatening to spill out of control, United Arab Emirates mini.....

Embattled former Malaysian Prime Minister Najib Razak was the main loser in last month&rsq.....

Lurking in the background of a Saudi-Moroccan spat over World Cup hosting rights and the Gulf crisis.....

Amid ever closer cooperation with Saudi Arabia, Israel’s military appears to be adopting the k.....

Mounting anger and discontent is simmering across the Arab world much like it did in the w.....

Argentina’s cancellation of a friendly against Israel because of Israeli attempts to exploit t.....

Saudi Arabia’s bitter rivalry with Iran has spilled onto Asian soccer pitches with t.....

A controversy in Algeria over the growing popularity of Saudi-inspired Salafi scholars spotlights th.....

Subtle shifts in Chinese energy imports suggest that China may be able to exert influence in the Mid.....

Egyptian general-turned-president Abdel Fattah Al-Sisi won a second term virtually unchallenged in w.....

Protests have erupted in Iran’s oil-rich province of Khuzestan barely three months after the I.....

Debilitating hostility between Saudi Arabia and Iran is about lots of things, not least who will hav.....

Saudi Arabia, in an indication that it is serious about shaving off the sharp edges of its Sunni Mus.....

The Middle East has a knack for sucking external powers into its conflicts. China’s ventures i.....

A Saudi draft law could constitute a first indication that Crown Prince Mohammed bin Salman’s .....

Turkish allegations of Saudi, Emirati and Egyptian support for the outlawed Kurdish Workers Party (P.....

Prominent US constitutional lawyer and scholar Alan M. Dershowitz raised eyebrows when he described .....

Plans to open a Salafi missionary centre in the Yemeni province of Al Mahrah on the border with Oman.....

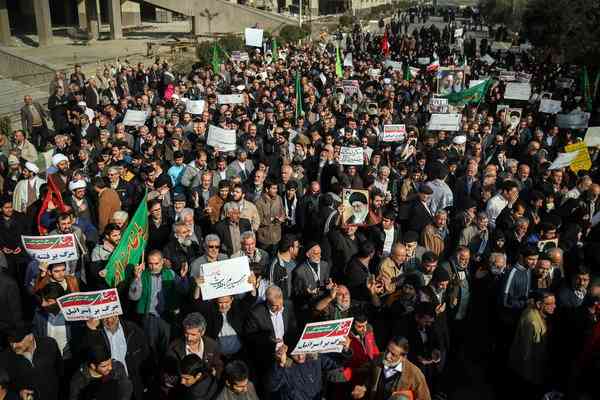

If week-long anti-government protests in Iran exposed the Islamic republic’s deep-se.....

Kuwaiti billionaire Maan al-Sanea should have seen it coming after Saudi Crown Prince Mohammed bin S.....

Long-standing Saudi efforts to dominate the pan-Arab media landscape appear to have moved into high .....

The proceedings of recent visit of the Chinese President Xi Jinping to UAE may not cast shadow on In.....

Subtle shifts in Chinese energy imports suggest that China may be able to exert influence in the Middle East i.....

Protests have erupted in Iran’s oil-rich province of Khuzestan barely three months after the Islamic rep.....

The recent violation of Israel’s air space by an Iranian drone and Israel’s retaliation against Sy.....

The Middle East has a knack for sucking external powers into its conflicts. China’s ventures into the re.....

Turkish allegations of Saudi, Emirati and Egyptian support for the outlawed Kurdish Workers Party (PKK) threat.....

If week-long anti-government protests in Iran exposed the Islamic republic’s deep-seated econo.....