Breaking

- MENU

Pakistani Prime Minister Imran Khan lands in Beijing on November 3, the latest head of government to seek a renegotiation of commercial terms and/or focus of projects related to China’s infrastructure and energy-driven Belt and Road initiative. He follows in the footsteps of his Malaysian counterpart, Mahathir Mohamad has suspended US$26 billion in Chinese-funded projects; while Myanmar is negotiating a significant scaling back of a Chinese-funded port project on the Bay of Bengal from one that would cost US$ 7.3 billion to a more modest development that would cost US$1.3 billion in a bid to avoid shouldering an unsustainable debt. China has also witnessed pushback and rising anti-Chinese sentiment in countries as far flung as Kazakhstan, Nepal, and Denmark.

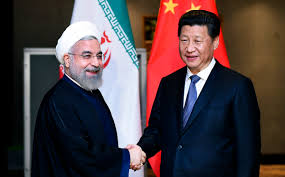

Khan’s insistence on expanding the focus of the China Pakistan Economic Corridor, a US$45 billion plus Belt and Road crown jewel, to include agriculture, manufacturing, and job creation takes on added significance as Pakistan seeks an approximately US$8 billion International Monetary Fund (IMF) bailout to help it avert a financial crisis and discusses with Saudi Arabia investments of up toUS$10 billion in investments that would be separate but associated with CPEC.

In doing so, Khan is manoeuvring multiple minefields that stretch from likely demands by the International Monetary Fund IMF and the United States for transparency on the financial nuts and bolts of CPEC projects to compliance with requirements of the Financial Action Task Force (FATF), an international anti-money laundering and terrorism finance watchdog that has threatened to blacklist Pakistan, to managing relations with Saudi Arabia at time that the kingdom’s international standing hangs in the balance as a result of the killing of journalist Jamal Khashoggi in the Saudi consulate in Istanbul.

Refocusing the Belt and Road

Preparing for his first visit to China as Pakistan’s prime minister, Imran Khan insisted that the focus of the China Pakistan Economic Corridor (CPEC), a US$45 billion plus crown jewel of the Belt and Road, shift from infrastructure to agriculture, job creation and foreign investment. “Earlier, the CPEC was only aimed at construction of motorways and highways, but now the prime minister decided that it will be used to support the agriculture sector, create more jobs mand attract other foreign countries like Saudi Arabia to invest in the country,” said information minister Fawad Chaudhry, ignoring the fact that the CPEC plan already made reference to those issues.1

Khan’s determination to be seen as ensuring that more benefits accrue to Pakistan from Chinese investment comes at a time that various Asian and African countries worry that Belt and Road related investments in infrastructure risk trapping them in debt and forcing them to surrender control of critical national infrastructure, and in some cases media assets.2 Malaysia has suspended or cancelled US$26 billion in Chinese-funded projects3 while Myanmar is negotiating a significant scaling back of a Chinese-funded port project on the Bay of Bengal from one that would cost US$ 7.3 billion to a more modest development that would cost US$1.3 billion in a bid to avoid shouldering an unsustainable debt.4

CWE Investment Corporation, a subsidiary of China Three Gorges is considering pulling out of a 750MW hydropower project citing high resettlement and rehabilitation costs in the wake of protests against the planned evacuation of eight Nepali villages.5 Fears of a debt trap started late last year when unsustainable debt forced Sri Lanka to hand China an 80% stake in Hambantota port.6 China has written off an undisclosed amount of Tajik debt in exchange for ceding control of some 1,158 square kilometres of disputed territory7 close to the Central Asian nation’s border with China’s troubled north-western province of Xinjiang. Zambia saw itself left with no choice but to hand over control of its international airport as well as a state power company.8

Pakistan, even before Khan called for a refocusing of CPEC, was becoming more cautious about Chinese investment. Pakistani Water and Power Development Authority chairman Muzammil Hussain charged that “Chinese conditions for financing the Diamer-Bhasha Dam were not doable and against our interests.” China and Pakistan were also at odds over ownership of the $14 billion, 4,500 megawatts (MW)-hydropower project on the Indus River in the country’s problematic region of Gilgit-Baltistan near disputed Kashmir.9 Earlier, a State Bank of Pakistan study concluded that exports of marble to China, Pakistan’s foremost rough-hewn, freshly-excavated marble export market, and the re-export to Pakistan of Pakistani semi-processed marble was “hurting Pakistan’s marble industry to a significant extent.”10

Khan’s chances of refocusing CPEC may be boosted by domestic and foreign blowback China is experiencing. Chinese President Xi Jinping’s pledge in September of US$60 billion in new loans to Africa triggered a wave of grumbling in China. Censors quickly moved to delete critical posts that proliferated online after Xi announced the fresh commitments to counter assertion that the Belt and Road amounted to debt trap diplomacy.11

China too is apparently becoming more cautious. Reduced Chinese investment in Pakistan accounted for a 42 percent drop in foreign direct investment in the first quarter of this fiscal year. The central bank reported that investment from China, Pakistan’s largest foreign investor had dropped in the period from July to September to US$439.5 million compared to US$765 million in the previous year. The decline fuelled concern and contributed to Pakistan’s decision to ask the IMF for support.

Tackling Key Issues

The Khan government’s desire to refocus CPEC tackles key issues raised by critics of the project that potentially could impact China’s plan to pacify its troubled north-western province of Xinjiang through a combination of economic development and brutal repression and re-education of its Turkic Muslim population. The initial plan for CPEC appeared to position Pakistan as a raw materials supplier for China, an export market for Chinese products and labour, and an experimental ground for the export of the surveillance state China is rolling out in Xinjiang.12

The plan envisioned Chinese state-owned companies leasing thousands of hectares of agricultural land to set up “demonstration projects” in areas ranging from seed varieties to irrigation technology. Chinese agricultural companies would be offered “free capital and loans” from various Chinese ministries as well as the China Development Bank. It further projected the Xinjiang Production and Construction Corps introducing mechanization as well as new technologies in Pakistani livestock breeding, development of hybrid varieties, and precision irrigation. Pakistan effectively would become a raw materials supplier rather than an added-value producer, a prerequisite for a sustainable textiles industry.

The plan saw the Pakistani textile sector as a supplier of materials such as yarn and coarse cloth to textile manufacturers in Xinjiang. “China can make the most of the Pakistani market in cheap raw materials to develop the textiles & garments industry and help soak up surplus labour forces in (Xinjiang’s) Kashgar,” the plan said. Chinese companies would be offered preferential treatment with regard to “land, tax, logistics and services” as well as “enterprise income tax, tariff reduction and exemption and sales tax rate” incentives.13 For Khan to ensure that Pakistani agriculture benefits, the very concept of Chinese investment in Pakistani agriculture would have to renegotiated. Similarly, Khan has yet to express an opinion on the plan’s incorporation of a full system of monitoring and surveillance that would be built in Pakistani cities to ensure law and order.

The system would involve deployment of explosive detectors and scanners to “cover major roads, case-prone areas and crowded places…in urban areas to conduct real-time monitoring and 24-hour video recording.” The surveillance aspect of the plan that identifies Pakistani politics, such as competing parties, religion, tribes, terrorists, and Western intervention” as well as security as the greatest risk to CPEC could, if unaddressed, transform Pakistani society in ways that go far beyond economic and infrastructure development.14

The Saudi Factor

Khan’s insistence on a refocus of CPEC takes on added significance given that Pakistan is turning to the International Monetary Fund (IMF) to help it avert a financial crisis with a loan of up to US$12 billion 15 and its agreements with Saudi Arabia involving US$ 6 billion in financial support and could produce some US$10 billion in investments that would be separate but associated with CPEC.16China worries that Saudi investments would reduce Pakistani dependence on the People’s Republic and is believed to have persuaded Pakistan to backtrack on its initial announcement that Saudi Arabia would become a partner in CPEC rather than invest separately from the People’s Republic.17 Lijian Zhao, China’s deputy chief of mission in Islamabad sought to smoothen potentially ruffled feather by insisting that his country welcomed Saudi investments as part of any effort to develop Pakistani infrastructure, raise living standards and create jobs.18

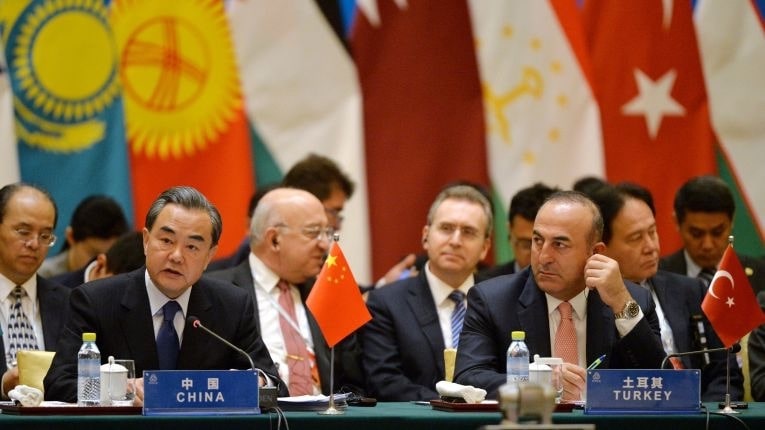

In an interview19 as well as a series of tweets20 Zhao insisted that China welcomed Saudi investment and “always supported & stood behind @ Pakistan, helping #develop it’s #infrastructure & raise #living standards while creating #job.” Zhao’s comments followed a statement in September by Chinese foreign minister Wang Ji after talks with Khan in Islamabad that appeared to indicate that China, while acknowledging Pakistani demands, would not address them immediately. Wang suggested that CPEC would only “gradually shift to industrial cooperation."21

In a further implicit recognition that at least some of its Belt and Road-related projects risk trapping target countries in debt or fail to meet their needs, has conceded that adjustments may be necessary. "It's normal and understandable that development focus can change at different stages in different countries, especially with changes in government. So China can also make some strategic adjustments when cooperating with these countries, but it's definitely not a reconsideration of the B&R (Belt and Road) initiative," Wang Jun, deputy director of the Department of Information at the China Center for International Economic Exchanges told the Chinese Communist Party’s Global Times newspaper.22

Said Financial Times columnist Jamil Anderlini:” China is at risk of inadvertently embarking on its own colonial adventure in Pakistan— the biggest recipient of BRI investment and once the East India Company’s old stamping ground… Pakistan is now virtually a client state of China. Many within the country worry openly that its reliance on Beijing is already turning it into a colony of its huge neighbour. The risks that the relationship could turn problematic are greatly increased by Beijing’s ignorance of how China is perceived abroad and its reluctance to study history through a non-ideological lens... It is easy to envisage a scenario in which militant attacks on Chinese projects overwhelm the Pakistani military and China decides to openly deploy the People’s Liberation Army to protect its people and assets. That is how ‘win-win’ investment projects can quickly become the foundations of empire.”23

A Linchpin of Chinese Policy

China, moreover, frets that in a worst-case scenario, Saudi investment rather than boosting economic activity and helping Gwadar get out of starting blocks, could ensnare it in one of the Middle East’s most debilitating conflicts. China is further concerned that there would be a set of third-party eyes monitoring activity if and when it decides to use Gwadar not only for military purposes but also as a naval facility. Saudi investment would also thwart potential Chinese plans to link the ports of Gwadar and Chabahar, a prospect that Pakistani and Iranian officials have not excluded.

Indeed, Khan’s involvement of Saudi Arabia could complicate tensions in Balochistan where China is already a target for nationalist and/or religious militants by potentially drawing Pakistan into the escalating rivalry between Saudi Arabia and Iran and putting Saudi investments in the firing line. A Balochistan Liberation Army (BLA) suicide bomber driving an Iranian manufactured Zamyad oil transporter killed three Chinese engineers and two Pakistani frontier guards in August when he attacked a bus carrying them to the Saindak copper and gold mine that is operated by the Metallurgical Corporation of China.24

A Rand Corp study asserted in 2014 that Pakistan is “the linchpin of China’s South Asiapolicy.”25 “Islamabad is considered a key capital to help Beijing deal with the challenge both in terms of cracking down on radical Islamic groups supporting and training Uighurs in Pakistan as well as helping to cast China as friend of the Muslim world… Pakistan is also important to China because it is considered critical to stabilizing neighbouring Afghanistan—a country that has become of growing concern to China as a source of terrorism and heroin… From China’s perspective Pakistan has a key role to play…in actively advancing China’s economic relations with the region and the world. Beijing seeks a government in Islamabad that can maintain order inside Pakistan and also help stabilize Afghanistan,” the study said.

Another Rand Corp research paper noted that Pakistan is China’s largest military hardware export market. Pakistan accounted for 42 per cent of China’s total arms sales in the years between 2000 and 2014.26 In a move designed as much to strengthen Pakistani counterterrorism capabilities as a gesture towards the armed forces, made Pakistan the second country after Saudi Arabia to receive killer drones and the associated technology.27 The US has refused to sell its more advanced killer drones to either Saudi Arabia or Pakistan.

Pakistan’s powerful military and intelligence service, Inter-Services Intelligence (ISI) is determined to play an important role in Khan’s manoeuvring of the Chinese and Saudi minefields. Handpicked by Chief of Army Staff General Qamar Javed Bajwa, ISI’s new head, Lieutenant General Asim Munir, garnered experience in dealing with both China and the kingdom while he served in the province of Gilgit-Baltistan that borders on the People’s Republic and when he was seconded to Saudi Arabia.28

Saudi Arabia is considering investing in a refinery in the Baloch Arabian Sea, Chinese-operated port of Gwadar that is a key node in China’s strategy to fuel economic development in its troubled north-western province of Xinjiang. Saudi Arabia is also looking at putting money into the Reko Diq copper and gold mine, that like Gwadar is close to Iranian border and a mere 70 kilometres from Iran’s Indian-backed port of Chabahar.

Ironically, the death of Saudi journalist Jamal Khashoggi has turn out to be a blessing in disguise for Khan. After two visits to Riyadh in the first two months of his prime minister ship that did not persuade the Saudis to give him the cash relief he needs, Khan earned brownie points by attending a high-profile in October in Riyadh that was boycotted by Western CEO’s and government officials. Khan was received in private audience by King Salman and his embattled son, Crown Prince Mohammed bin Salman.

Speaking in an interview before leaving for Riyadh, Khan said he was attending the conference despite the “shocking” killing of Khashoggi because “unless we get loans from friendly countries or the IMF, we actually won’t have in another two or three months enough foreign exchange to service our debts or to pay for our imports. So we’re desperate at the moment.”29 Pakistan’s foreign reserves dropped this month to US$8.1 billion, a four-year low and barely enough to cover sovereign debt payments due through the end of the year. The current account deficit has swelled to about $18 billion.30

The potential Saudi investments were only part of Khan’s shopping list presented to the Saudis on two visits to the kingdom since he came to office in August. Ironically, the killing in Istanbul of Jamal Khashoggi got the Pakistani prime minister what the chastened Saudis had denied him earlier as a reward for his participation in a major investors’ conference in Riyadh that Western leaders, politicians and company boycotted in the wake of the Saudi journalist’s gruesome murder: US$6 billion in deferred oil payments and a deposit in the central bank to alleviate Pakistan’s cash crunch.31

Conclusion

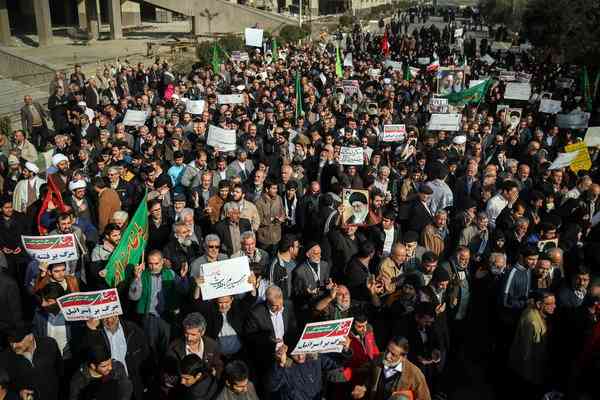

Armed with the Saudi aid, Khan arrives in Beijing more confident that he can secure similar Chinese support. His talks are likely to be clouded by the question whether and, if so, what geopolitical price he may have paid for the Saudi aid. Ensuring that Pakistan, home to the world’s largest Shiite minority, does not snuggle up too much to Iran has become even more crucial for Saudi Arabia as it seeks in the wake of Khashoggi’s death to enhance its indispensability to US President Donald J. Trump’s effort to isolate and cripple Iran economically, if not to engineer a change of regime in Tehran. Trump sees Saudi Arabia as central to his strategy aimed at forcing the Islamic republic to halt its support for proxies in Yemen and Lebanon, withdraw its forces from Syria, and permanently dismantle its nuclear and ballistic missiles programs.

Saudi financial support means that Khan may find it more difficult to shield Pakistan from being sucked into the US-Saudi effort with potentially far-reaching consequences for Chinese investment, particularly in Balochistan. “There will be at a minimum Saudi expectations and perhaps even demands, when it comes to Pakistan’s support for issues that are of interest to the Saudi monarchy. When he was an opposition figure, Khan seemed to understand that and hence decried the secret deal that the previous PML-N (Pakistan Muslim League-Nawaz) rulers had struck with the Saudis in return for a loan,” Dawn, Pakistan’s leading English-language daily, said in an editorial.32

Pakistani finance minister Asad Umar denied that the Saudi support came with political strings. "The Saudis did not make any demands that we refused to meet. They made no demands. And this is the Pak-Saudi relation; it's a people-to-people connection. They will stand by Pakistan's side during our time of need,” Umar said.33 Khan is moreover likely to argue in Beijing that Saudi and Chinese aid would reduce his need to turn for help to the IMF that would demand insight into the financial terms of CPEC-related projects.

Insurgents kidnapped a week before Khan’s visit to Saudi Arabia 14 Iranian security personnel, reportedly including Revolutionary Guards on the Iranian side of the border with Pakistan. Pakistan pledged to help liberate the abductees who are believed to have been taken across the border into Balochistan, long a militant and Baloch nationalist hotbed.34 “Members of terrorist groups that are guided and supported by foreign forces carried this out through deceiving and bribing infiltrators,” the Guards said in a statement that appeared to blame Saudi Arabia and the United States without mentioning them by name.

References

(1) Syed Irfan Raza, CPEC focus must be on job creation, agriculture: Imran, Dawn, 9 October 2018, https://www.dawn.com/news/1437770/cpec-focus-must-be-on-job-creation-agriculture-imran

(2) James M. Dorsey, China struggles with Belt and Road pushback, The Turbulent World of Middle East Soccer, 16 September 2018, https://mideastsoccer.blogspot.com/2018/09/china-struggles-with-belt-and-road.html

(3) Kirsty Needham, Malaysia cancels Belt and Road projects with China over bankruptcy fears, The Sydney Morning Herald, 21 August

2018, https://www.smh.com.au/world/asia/china-malaysia-agree-to-mutual-respect-amid-belt-and-road-tensions-20180820-p4zyo3.html

(4) Jon Emont and Myo Myo, Chinese-Funded Port Gives Myanmar a Sinking Feeling, The Wall Street Journal, 15 August 2018, https://www.wsj.com/articles/chinese-funded-port-gives-myanmar-a-sinking-feeling-1534325404

(5) Yubaraj Ghimre, China Eyes Exit, Nepal’s West Seti Hydropower Project in Jeopardy, South China Morning Post, 30 August 2018,

https://www.scmp.com/week-asia/geopolitics/article/2161968/nepals-west-seti-hydropower-project-jeopardy-china-eyes-exit

(6) Gordon Fairclough and Uditha Jayasinghe, Sri Lanka to Sell 80% Stake in Strategically Placed Harbor to Chinese, The Wall Street Journal, 30 August 2016, https://www.wsj.com/articles/sri-lanka-to-sell-80-stake-in-strategically-placed-harbor-to-chinese1481226344?mod=article_inline

(7) Bakhtiyor Atovulloev, Takiistan is turning into the new province of China, Eurasia News, 30 December 2016, https://tajikopposition.com/2016/12/30/tajikistan-is-turning-into-the-new-province-of-china-eurasianews/

(8) Richard Krah, China to take over Zambia’s international Airport for debt repayment, African Stand, 8 September 2018, https://www.africanstand.com/news/africa/east-africa/china-to-take-over-zambias-international-airport-for-debt-repayment/

(9) Shahbaz RanaPakistan stops bid to include Diamer-Bhasha Dam in CPEC, The Express Tribune, 15 November 2017, https://tribune.com.pk/story/1558475/2-pakistan-stops-bid-include-diamer-bhasha-dam-cpec/

(10) State Bank of Pakistan, Marble and Marble Products, 2017, http://www.sbp.org.pk/departments/ihfd/SubSegment%20Booklets/Marble%20and%20Marble%20Products.pdf

(11) Lucy Hornby and Tom Hancock, China pledge of $60bn loans to Africa sparks anger at home, Financial Times, 5 September 2018, https://www.businessdayonline.com/financial-times/article/china-pledge-60bn-loans-africa-sparks-anger-home/

(12) James M. Dorsey, One Belt, One Road: A plan for Chinese dominance and authoritarianism, The Turbulent World of Middle East Soccer, 17 May 2017, https://mideastsoccer.blogspot.com/2017/05/one-belt-one-road-plan-for-chinese.html

(13) Ibid. Dorsey

(14) Ibid. Dorsey

(15) Khaleeq Kiani, Govt to seek IMF bailout programme, Dawn, 9 October 2018, https://www.dawn.com/news/1437773/govt-to-seekimf-bailout-programme

(16) James M. Dorsey, The Khashoggi Crisis: A blessing in disguise for Pakistan’s Imran Khan, The Turbulent World of Middle East Soccer, 24 October 2018, https://mideastsoccer.blogspot.com/

(17) James M. Dorsey, Remodelling the Belt and Road: Pakistan picks up the torch, The Turbulent World of Middle East Soccer, 10 October 2018, https://mideastsoccer.blogspot.com/2018/10/remodelling-belt-and-road-pakistan.html

(18) Ayaz Gul, China Welcomes Saudi Plans to Invest in CPEC Project With Pakistan, Voice of America, 8 October 2018, https://www.voanews.com/a/china-welcomes-saudi-plans-invest-cpec-project-with-pakistan/4604946.html

(19) Ayaz Gul, China Welcomes Saudi Plans to Invest in CPEC Project With Pakistan, Voice of America, 8 October 2018, https://www.voanews.com/a/china-welcomes-saudi-plans-invest-cpec-project-with-pakistan/4604946.html

(20) Lijian Zhao, Twitter, 9 October 2018, https://twitter.com/beltroadnews/status/1049591338893750273

(21) Saeed Shah, Pakistan Pushes China to Realign Goals in Its Belt-and-Road Initiative, The Wall Street Journal, 12 September 2018, https://www.wsj.com/articles/pakistan-pushes-china-to-realign-goals-in-its-belt-and-road-initiative-1536773665

(22) Shen Weiduo, China open to adjustment of B&R projects based on countries' needs: analysts, Global Times, 9 September 2018, http://www.globaltimes.cn/content/1119564.shtml

(23) Jamil Anderlini, China is at risk of becoming a colonialist power, Financial Times, 19 September 2018, https://www.ft.com/content/186743b8-bb25-11e8-94b2-17176fbf93f5

(24) Syed Ali Shah, 3 Chinese nationals among 5 injured in Dalbandin suicide attack, Dawn, 11 August 2018, https://www.dawn.com/news/1426367/3-chinese-nationals-among-5-injured-in-dalbandin-suicide-attack

(25) Andrew Scobell, Ely Ratner, and Michael Beckley, China’s Strategy Toward South and Central Asia: An Empty Fortress, Santa Monica, Calif.: RAND Corporation, 2014 https://www.rand.org/pubs/research_reports/RR525.html

(26) Andrew Scobell et. al, At the Dawn of Belt and Road, China in the Developing World, Santa Monica, Calif.: RAND Corporation, 2018, https://www.rand.org/pubs/research_reports/RR2273.html

(27) Asia Times, China sells drones, transfers drone technology to Pakistan, 9 October 2018, http://www.atimes.com/article/china-sellsdrones-transfers-drone-technology-to-pakistan/?utm_source=The+Daily+Report&utm_campaign=dc237e721fEMAIL_CAMPAIGN_2018_10_09_08_51&utm_medium=email&utm_term=0_1f8bca137f-dc237e721f-31513393

(28) Kunwar Khuldine Shahid, Pakistan gets a hardline spy master to head the ISI, Asia Times, 15 October 2018, http://www.atimes.com/article/pakistan-gets-a-hardline-spy-master-to-head-the-isi/

(29) Jonathan Steele, Imran Khan: Pakistan cannot afford to snub Saudis over Khashoggi killing, Middle East Eye, 22 October 2018, https://www.middleeasteye.net/news/imran-khan-pakistan-khashoggi-iran-saudi-arabia-syria-764307301

(30) Reuters, Pakistan 'desperate' for Saudi loans to shore up economy: PM Imran, 22 October 2018, https://tribune.com.pk/story/1831630/1-pakistan-desperate-saudi-loans-shore-economy-pm/

(31) Ibid. Dorsey, The Khashoggi Crisis

(32) Dawn, Saudi loan, 25 October 2018,

(33) Dawn, PTI govt has nothing to do with hike in power tariff: Asad Umar, 25 October 2018,

https://www.dawn.com/news/1441186/saudi-loan https://www.dawn.com/news/1441186/saudi-loan https://www.dawn.com/news/1441263/pti-govt-has-nothing-to-do-with-hike-in-power-tariff-asad-umar

(34) Agence France Presse, Iran’s spy officers among 14 security personnel kidnapped on Pakistan border, 16 October 2018, https://tribune.com.pk/story/1827199/1-irans-spy-officers-among-14-security-personnel-kidnapped-pakistan-border/

Note: This article was originally published in the blog, The Turbulent World of Middle East Soccer and has been reproduced under arrangement. Web link

James M. Dorsey is a Senior Fellow at the S. Rajaratnam School of International Studies as Nanyang Technological University in Singapore, co-director of the Institute of Fan Culture of the University of Würzburg, and the author of the blog, The Turbulent World of Middle East Soccer. Email: jmdorsey@questfze.com

As part of its editorial policy, the MEI@ND standardizes spelling and date formats to make the text uniformly accessible and stylistically consistent. The views expressed here are those of the author and do not necessarily reflect the views/positions of the MEI@ND. Editor, MEI@ND: P R Kumaraswamy

James M. Dorsey is a Senior Fellow at the S. Rajaratnam School of International Studies as Nanyang Technological University in Singapore, co-director of the Institute of Fan Culture of the University of Würzburg, and the author of the blog, The Turbulent World of Middle East Soccer. Email: jmdorsey@questfze.com

The final run-up to the 2022 World Cup and the tournament's management is make-it-or-break-it ti.....

Former Qatari emir Hamad bin Khalifa Al Thani, the father of the Gulf state's current ruler, Tam.....

The Biden administration is mulling whether to grant Saudi Crown Prince Mohammed bin Salman sovereig.....

Qatar's 2022 World Cup promises to benefit not only itself but also to provide an unintended eco.....

A potential revival of the Iran nuclear accord is likely to test the sustainability of Middle Easter.....

With the fate hanging in the balance of the 2015 international agreement that curbed Iran’s nu.....

At first glance, there is little that Turkish President Recep Tayyip Erdogan, an Islamist and nation.....

Europe is likely to shoulder the brunt of the fallout of a rapidly escalating crisis over Ukraine. M.....

An Israeli NGO gives the United Arab Emirates high marks for mandating schoolbooks that teach tolera.....

How sustainable is Middle Eastern détente? That is the $64,000 question. The answer is probab.....

Qatar has begun to cleanse its schoolbooks of supremacist, racist or derogatory references as well a.....

Long banned, Christmas has finally, at least tacitly, arrived in Saudi Arabia; just don’t use .....

Increasingly, compliance with US sanctions against Iran could emerge as a litmus test of the United .....

Footballers with diametrically opposed views on homosexuality and alcohol consumption have sparked h.....

Saudi Islamic affairs minister Abdullatif bin Abdulaziz al-Sheikh has ordered imams in the kingdom t.....

The United States has signalled in advance of next week’s Summit for Democracy that it is unli.....

A cursory look at Saudi Arabia and Iran suggests that emphasizing human rights in US foreign policy .....

When seven-time Formula One world champion Lewis Hamilton wore a helmet this weekend featuring the c.....

It has been a good week for United Arab Emirates Crown Prince Mohammed bin Zayed. Headline-grabbing,.....

Just in case there were any doubts, Turkish Foreign Minister Mevlut Cavusoglu demonstrated with his .....

Sudan is the exception to the rule in the United Arab Emirates’ counterrevolutionary playbook......

Former Saudi intelligence chief Prince Turki AlFaisal Al Saud must have gotten his tenses mixed up w.....

An Indonesian promise to work with the United Arab Emirates to promote ‘moderate’ Islam .....

As Middle Eastern states attempt to manage their political and security differences, Muslim-majority.....

The future of US engagement in the Middle East hangs in the balance. Two decades of forever war in A.....

It may not have been planned or coordinated but efforts by Middle Eastern states to dial down tensio.....

Gulf States are in a pickle. They fear that the emerging parameters of a reconfigured US commitment .....

Two separate developments involving improved relations between Sunni and Shiite Muslims and women&rs.....

On their way from Tel Aviv airport to Jerusalem in 1977 then Israeli Deputy Prime Minister Yigael Ya.....

Saudi and Emirati efforts to define ‘moderate’ Islam as socially more liberal while bein.....

Turkish state-run television appears to have not gotten the message: Turkey and the United Arab Emir.....

The Taliban takeover of Afghanistan perpetuates a paradigm of failed governance in the Muslim world .....

Israel’s first post-Netanyahu government is seeking to rebuild fractured relations with the Je.....

Taliban advances in Afghanistan shift the Central Asian playing field on which China, India and the .....

Boasting an almost 1,000-kilometre border with Iran and a history of troubled relations between the .....

This month’s indictment of a billionaire, one-time advisor and close associate of former US Pr.....

A recent analysis of Middle Eastern states’ interventionist policies suggests that misguided b.....

The United States and Iran seem to be hardening their positions in advance of a resumption of negoti.....

A recent unprecedented alliance between Muslims and Evangelicals takes on added significance in a wo.....

China may have no short-term interest in contributing to guaranteeing security in parts of a swath o.....

The rise of hard-line President-elect Ebrahim Raisi has prompted some analysts to counterintuitively.....

US President Joe Biden may have little appetite for Israeli-Palestinian peace making but seems deter.....

Recent announcements by Crown Prince Mohammed bin Salman of plans to turn the kingdom into a transpo.....

Saudi Arabia has stepped up efforts to outflank the United Arab Emirates and Qatar as the Gulf&rsquo.....

Eager to enhance its negotiating leverage with the United States and Europe, Iran is projecting immi.....

Former Crown Prince Hamzah bin Hussein has papered over a rare public dispute in the ruling Jordania.....

Former Crown Prince Hamzah bin Hussein has papered over a rare public dispute in the ruling Jordania.....

In a sign of the times, Turkish schoolbooks have replaced Saudi texts as the bull’s eye of cri.....

Saudi Sheikh Salman al-Awdah, a popular but controversial religious scholar who has been mostly in s.....

Recent clashes in the Iranian province of Sistan and Balochistan highlight Iran’s vulnerabilit.....

Two decades of snail pace revisions of Saudi schoolbooks aimed at removing supremacist references to.....

A little acknowledged provision of the 2015 international agreement that curbed Iran’s nuclear.....

Religion scholar Esra Ozyurek has a knack for identifying trends that ring warning bells about where.....

A projected sharp reduction in trade between the United States and China in the next two years coupl.....

Public debates about China’s Middle East policy are as much internal Chinese discussions as th.....

Saudi Arabia has taken multiple steps to polish its tarnished image in advance of this weekend&rsquo.....

An Emirati offer to invest in Israel’s most controversial soccer club could serve as a figurat.....

A close read of the agreement between the United Arab Emirates and Israel suggests that the Jewish s.....

A rift between Pakistan and Saudi Arabia throws into sharp relief deepening fissures in the Muslim w.....

Rare polling of public opinion in Saudi Arabia suggests that Crown Prince Mohammed bin Salman may be.....

China is contemplating greater political engagement in the Middle East in what would constitute a br.....

Europe is progressively being sucked into the Middle East and North Africa’s myriad conflicts......

China looms large as a potentially key player alongside Russia and Iran in President Bashas al-Assad.....

Civilizationalist leaders, who seek religious legitimacy, cater to a religious support base or initi.....

A decision by the Organization of Petroleum Exporting Countries (OPEC) and non-OPEC producers like R.....

The Coronavirus pandemic points a finger not only at the colossal global collapse of responsible pub.....

Syria’s announcement of its first COVID-19 case highlights the public health threat posed by w.....

The fight in this week’s Democratic primaries may have been about who confronts Donald J. Trum.....

A podcast version of this story is available on Sound cloud, ITunes, Spotify, Stitcher, Tune In, Spe.....

Saudi Arabia may have been getting more than it bargained for when authorities in Khujand, Tajikista.....

At the core of US president Donald J. Trump’s maximum pressure campaign against Iran lies the .....

The Iranian port city of Bandar-e-Mahshahr has emerged as the scene of some of the worst violence in.....

Saudi efforts to negotiate an end to the Yemen war in a bid to open a dialogue with Iran could call .....

China is manoeuvring to avoid being sucked into the Middle East’s numerous disputes amid mount.....

Fears of a potential military conflict with Iran may have opened the door to a Saudi-Iranian dialogu.....

By the law of unintended consequences, US President Donald J. Trump’s mix of uncritical and cy.....

Little suggests that fabulously wealthy Gulf States and their Middle Eastern and North African benef.....

A controversial former security official and Abu Dhabi-based political operator, Mohammed Dahlan, ha.....

Russia, backed by China, hoping to exploit mounting doubts in the Gulf about the reliability of the .....

China and Russia are as much allies as they are rivals. A joint Tajik-Chinese military exercise in a.....

Thought that sectarianism was a pillar of the Saud Iranian rivalry? Think again, think Kashmir where.....

These are tough times for Saudi Arabia. The drama enveloping the killing of journalist Jamal Khas.....

Saudi plans to become a major gas exporter within a decade raise questions about what the .....

A Turkish-Chinese spat as a result of Turkish criticism of China’s crackdown on Turkic Mu.....

This week’s suicide attack on Revolutionary Guards in Iran’s south-eastern province of S.....

Saudi Crown Prince Mohammed bin Salman’s three-nation tour of Asia is as much about demonstrat.....

It may be reading tea leaves but analysis of the walk-up to Saudi crown prince Mohammed bin Salman&r.....

Alarm bells went off last September in Washington's corridors of power when John Bolton&rsq.....

US President Donald J. Trump’s threat to devastate Turkey’s economy if Turkish troo.....

Pakistan is traversing minefields as it concludes agreements on investment, balance of payments supp.....

A heavy soup made of pulled noodles, meat, and vegetables symbolizes Central Asia’s close cult.....

As far as Gulf leaders are concerned, President Donald J. Trump demonstrated with his announced.....

When President Recep Tayyip Erdogan recently declared that Turkey was “the only country that c.....

A draft US Senate resolution describing Saudi policy in the Middle East as a "wrecking ball&quo.....

As Saudi crown prince Mohammed bin Salman tours friendly Arab nations in advance of the Group of 20 .....

When Saudi General Khalid bin Sultan bin Abdul Aziz went shopping in the late 1980s for Chinese medi.....

Saudi Arabia and Turkey, despite being on opposite sides of Middle Eastern divides, are cooperating .....

It’s easy to dismiss Iranian denunciations of the United States and its Middle Eastern allies .....

An attack on a military parade in the southern Iranian city of Ahwaz is likely to prompt Iranian ret.....

A Financial Action Task Force (FATF) report criticizing Saudi Arabia’s anti-money laundering a.....

Desperate for funding to fend off a financial crisis fuelled in part by mounting debt to China, Paki.....

Iran has raised the spectre of a US-Saudi effort to destabilize the country by exploiting .....

A possible ceasefire between Israel and Hamas, the Islamist group that controls the Gaza S.....

With multiple Middle Eastern disputes threatening to spill out of control, United Arab Emirates mini.....

Embattled former Malaysian Prime Minister Najib Razak was the main loser in last month&rsq.....

Lurking in the background of a Saudi-Moroccan spat over World Cup hosting rights and the Gulf crisis.....

Amid ever closer cooperation with Saudi Arabia, Israel’s military appears to be adopting the k.....

Mounting anger and discontent is simmering across the Arab world much like it did in the w.....

Argentina’s cancellation of a friendly against Israel because of Israeli attempts to exploit t.....

Conventional wisdom has it that China stands to benefit from the US withdrawal from the 2015 interna.....

Saudi Arabia’s bitter rivalry with Iran has spilled onto Asian soccer pitches with t.....

A controversy in Algeria over the growing popularity of Saudi-inspired Salafi scholars spotlights th.....

Subtle shifts in Chinese energy imports suggest that China may be able to exert influence in the Mid.....

Egyptian general-turned-president Abdel Fattah Al-Sisi won a second term virtually unchallenged in w.....

Protests have erupted in Iran’s oil-rich province of Khuzestan barely three months after the I.....

Debilitating hostility between Saudi Arabia and Iran is about lots of things, not least who will hav.....

Saudi Arabia, in an indication that it is serious about shaving off the sharp edges of its Sunni Mus.....

The Middle East has a knack for sucking external powers into its conflicts. China’s ventures i.....

A Saudi draft law could constitute a first indication that Crown Prince Mohammed bin Salman’s .....

Turkish allegations of Saudi, Emirati and Egyptian support for the outlawed Kurdish Workers Party (P.....

Prominent US constitutional lawyer and scholar Alan M. Dershowitz raised eyebrows when he described .....

Plans to open a Salafi missionary centre in the Yemeni province of Al Mahrah on the border with Oman.....

If week-long anti-government protests in Iran exposed the Islamic republic’s deep-se.....

Kuwaiti billionaire Maan al-Sanea should have seen it coming after Saudi Crown Prince Mohammed bin S.....

Long-standing Saudi efforts to dominate the pan-Arab media landscape appear to have moved into high .....